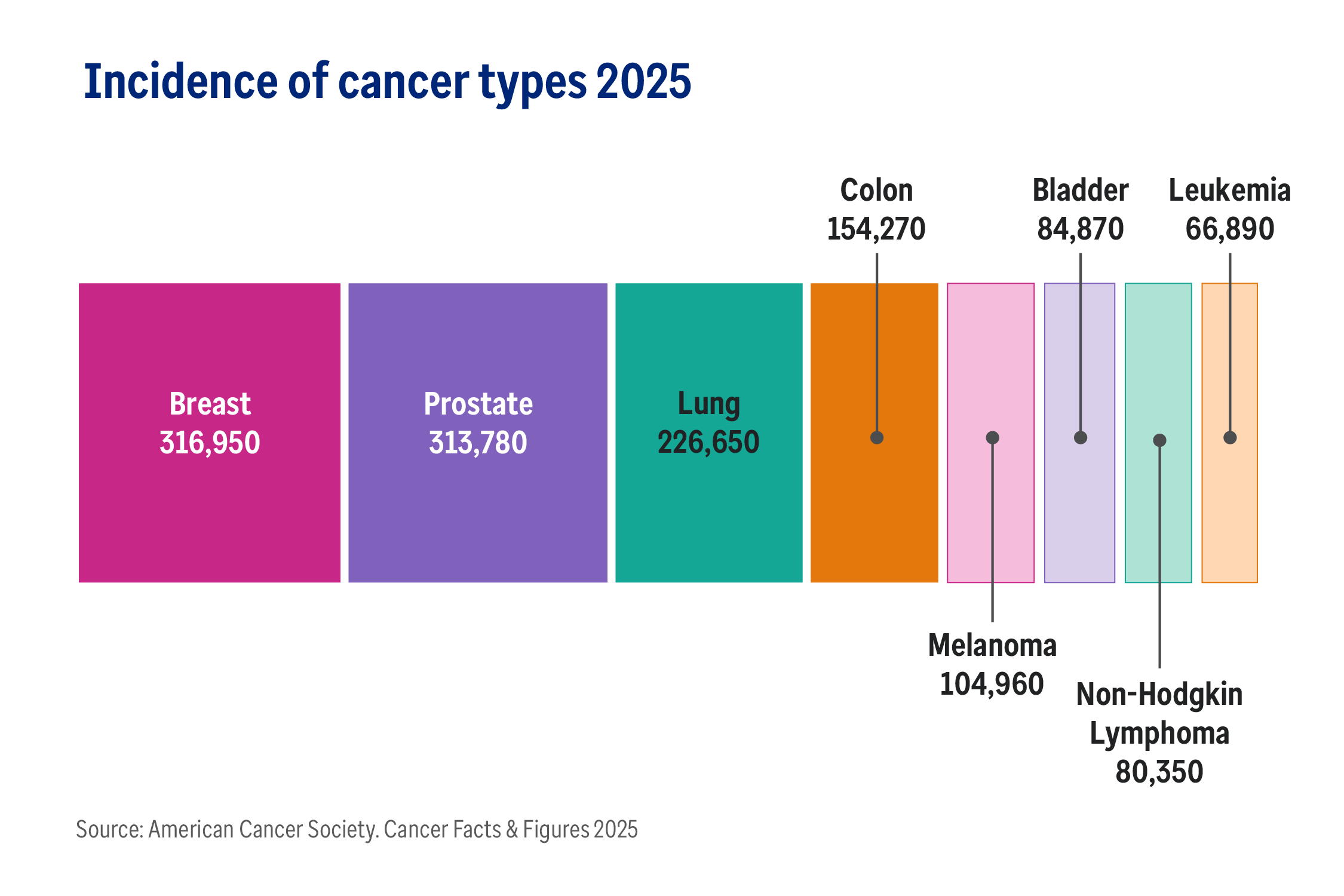

With over 2 million Americans expected to be diagnosed with cancer in 2025, advances in oncology are always welcome.1

While efforts to defeat cancer trace back centuries, the oncology landscape has transformed quite rapidly in recent years. Building upon decades of accumulating research, a wave of new drugs and therapy classes are now advancing through the development pipeline and entering the market.

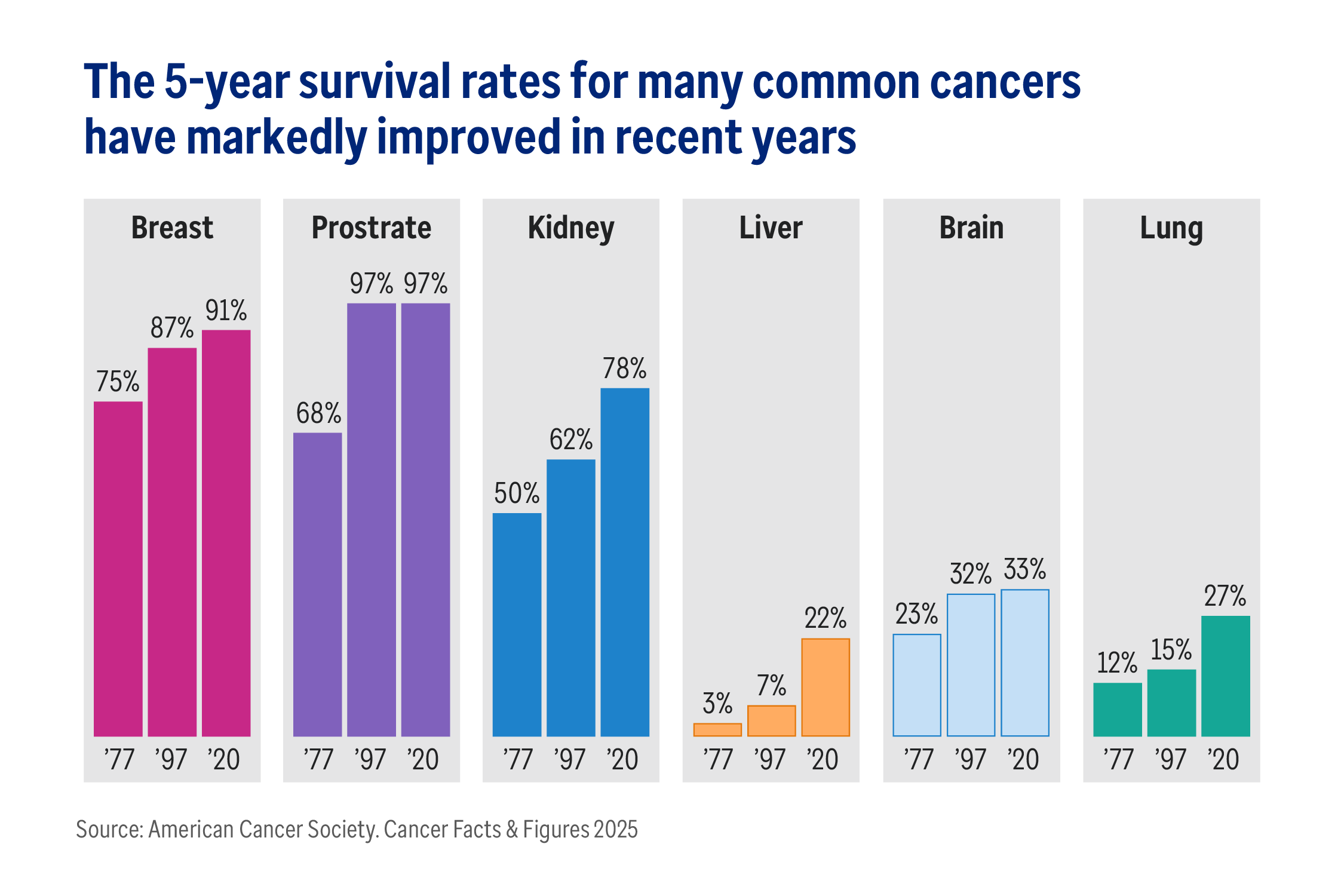

This influx of innovative therapies is giving physicians additional options while affording patients new hope, improving survival rates and quality of life. Yet, many of these advances come at a significant cost increase compared with existing therapies, making careful management of oncological medicines an increasingly urgent priority for plan sponsors.