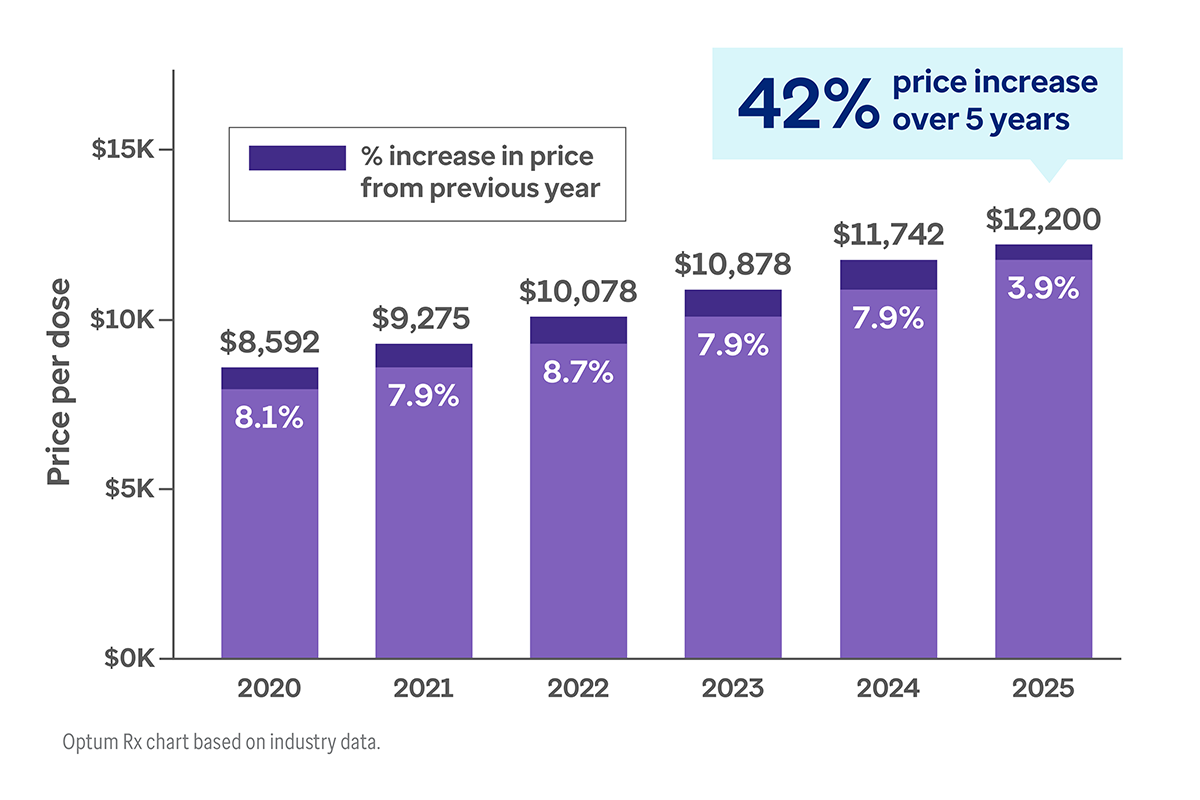

Price increases for prescription drugs add up over time

When we talk about the high cost of drugs, we’re usually thinking about headline-grabbing prices for a new drug at launch. And it’s true that new drug prices are increasing very fast.1

But there’s one little-remarked aspect of the rising cost of prescription drugs: With certain limited exceptions (e.g., Medicare), drug companies are free to set prices as high as the market will bear and then raise these prices any time they choose. And so they do; year after year.

As a result, most pharmaceutical revenue comes from these steady price increases for existing drugs over a period of years.2

This is a more serious problem than it might seem for two reasons:

- Price increases for branded drugs continue to outpace inflation by a wide margin.

- The compounding effect of multiple price increases over a period of years can result in significant cumulative increases – often with no corresponding improvement to the drug.3