GLP-1s are more effective than other weight loss medications

Researchers and clinicians have been warning about the tremendous costs from obesity for many years. Yet, the upward trend in prevalence and spending for obesity seemed unstoppable. In 2010, approximately 36% of U.S. adults were obese.1 By 2020, the proportion who were obese had risen to 42%.2

Today it is estimated that obesity is generating $426 billion in annual costs to U.S. businesses and employees. These include direct medical costs and costs for disability, workers comp, and lost productivity.3

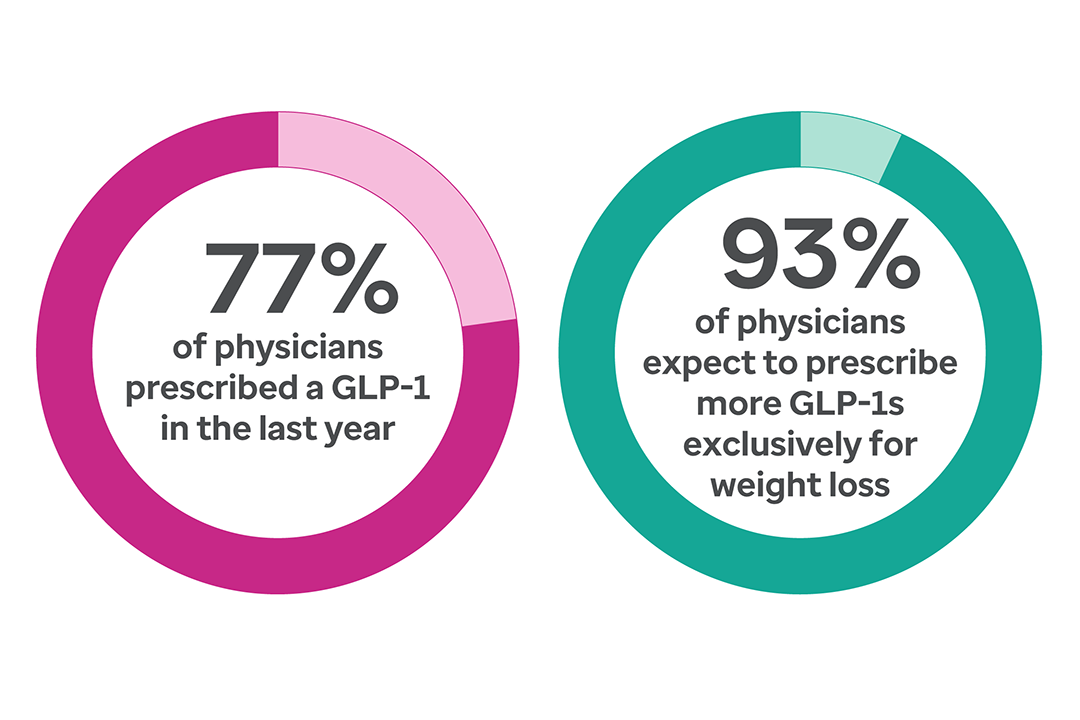

But, seemingly overnight, GLP-1s have changed how we think about treating and managing obesity. Some of the brand names include Ozempic®, Wegovy®, Mounjaro® and ZepBound®. Suddenly there's huge awareness, whether on social media, talking to neighbors or watching TV. The odds are good that you know someone who has taken a GLP-1 or other weight loss medication.

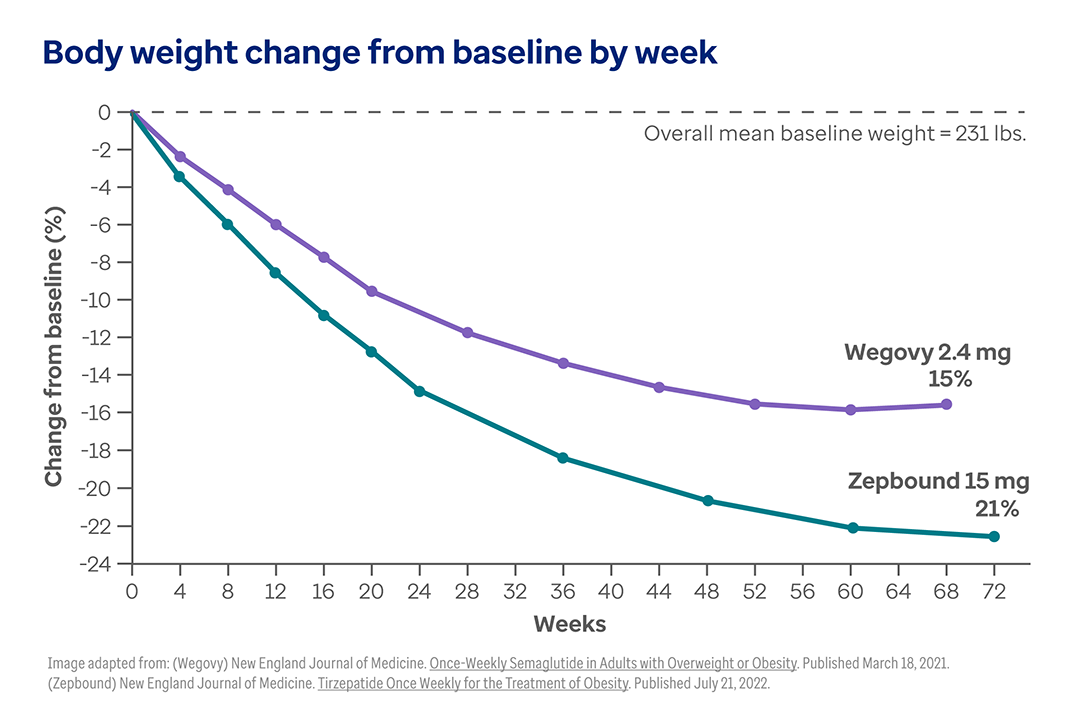

The main reason for all the excitement is simple: These drugs work. Patients routinely achieve double-digit percentage reductions in body fat when taking them.4

Not only are GLP-1 and similar drugs highly effective at their original purpose of controlling blood sugar for diabetes, they are also much more effective than any previous weight loss medications.