Boomers continue to drive change

The first Baby Boomers began to turn 65 in 2011. In the years since, the percentage of Americans aged 65 and older has grown by more than one third – to nearly 17% of the population.4

But aside from their percentage of the population, the reason we’re interested in the Boomers here is that so many of them are still working.

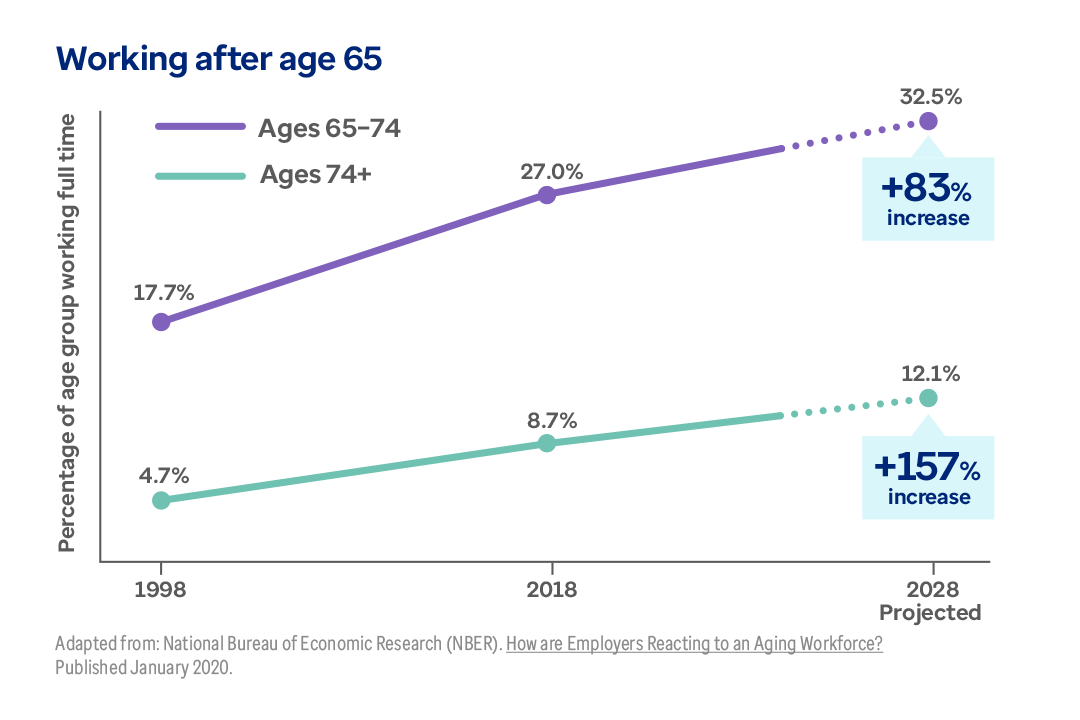

The percentage of workers aged 65 through 74 is projected to rise by more than 83% by the year 2028. Meanwhile, the number of workers over age 75 will increase by 157%.