There are 3 key changes in 2026 for patients with Medicare Part D

These changes affect all Medicare Part D members regardless of insurance carrier. Optum® Specialty Pharmacy and Optum® Infusion Pharmacy can help you navigate these changes.

Higher deductible

The deductible has increased from $590 to $615

Higher maximum

The out of pocket maximum has increased from $2,000 to $2,100

Automatic renewal

Automatic renewal in the Medicare Prescription Payment Plan if enrolled in 2025 and no plan change.

Standard deductible is increasing to $615

Patients have 3 payment stages as part of their Part D pharmacy benefit: deductible, initial coverage and catastrophic coverage.

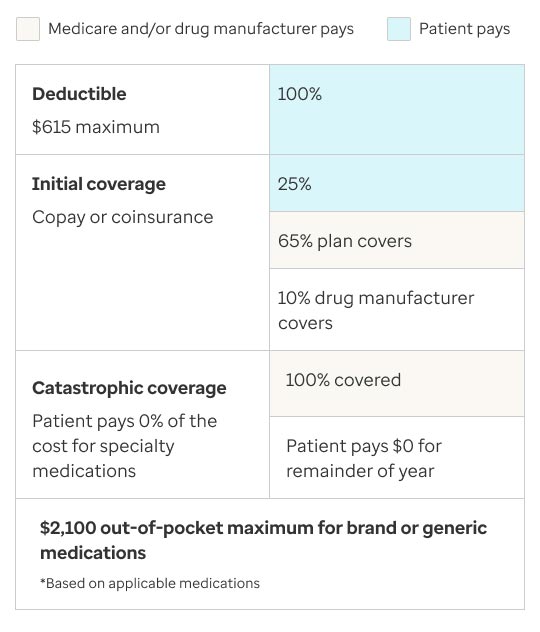

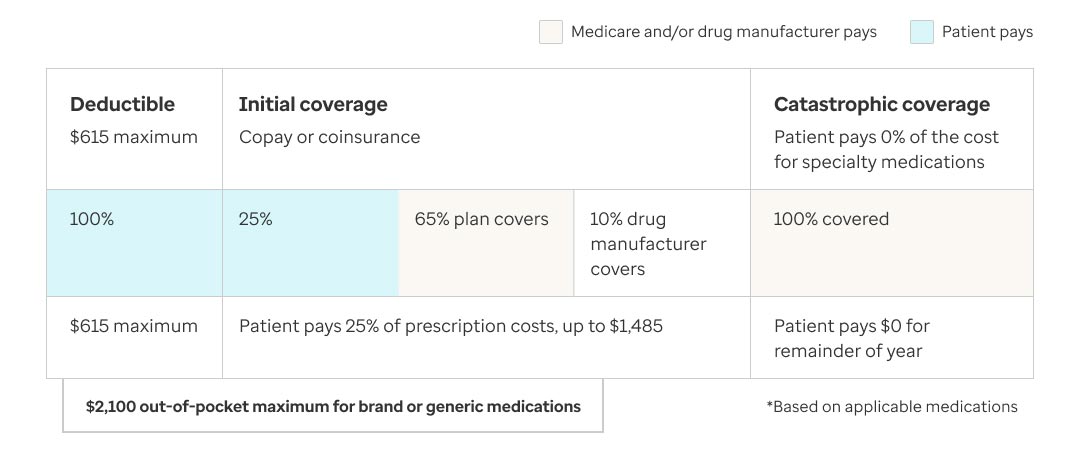

2026 Medicare Part D Payment Stages

The chart explains how patients with Medicare Part D will pay for their prescription medications in 2026. There are three payment stages:

- Deductible stage: Patients pay 100% of their prescription costs until they reach the annual deductible amount, which is $615 in 2026.

- Initial coverage stage: After meeting the deductible, patients pay 25% of their prescription costs (copay or coinsurance) up to a total out-of-pocket amount of $1,485.

- Catastrophic coverage stage: Once the patient’s total out-of-pocket costs reach $2,100 for the year, they enter catastrophic coverage. In this stage, patients pay $0 for covered prescriptions for the rest of the year.

Slightly higher maximum out-of-pocket

In 2026, the annual out-of-pocket maximum for Medicare Part D medication will be raised to $2,100. That’s $100 more than it was in 2025. Payments toward the annual deductible, copays and coinsurance for covered prescriptions — both brand-name and generic — count toward this maximum. Once patients reach the $2,100 threshold, they enter the catastrophic coverage stage and no longer pay out-of-pocket for covered prescriptions.

Optum Specialty Pharmacy and Optum Infusion Pharmacy are committed to lowering each patient’s out-of-pocket costs. With the help of Optum Savings IQ® financial assistance solutions, we aim to reduce the financial burden and boost medication access and adherence.

Medicare Prescription Payment Plan enrollment

Introduced in 2025, the Medicare Prescription Payment Plan (MPPP) lets Part D patients spread out their out-of-pocket medication costs into monthly payments, making budgeting easier. Enrollment is optional and may not suit everyone.

Patients enrolled in the MPPP in 2025 will be automatically re-enrolled for 2026. If they change plans, they’ll need to re-enroll with the new plan provider. Patients can opt into or out of the program at any time throughout the year.

Put us to work for your patients

We can help make medications more affordable for your patients, whether they are enrolled in the MPPP or not. Powered by Optum Savings IQ technology, our financial experts connect patients with all available financial assistance in real time. This helps reduce patient costs to the lowest possible price so they can start therapy without delay.

Before re-enrolling or starting patients on a free drug program, consider seeking assistance through Optum Specialty Pharmacy and Optum Infusion Pharmacy first. Not only do we help make medications more affordable and accessible, but we also provide clinical management programs and tailored communication to improve patient adherence and outcomes.

Your existing Medicare patients—and new Medicare patients—can continue to fill medications at Optum Specialty and Optum Infusion Pharmacies. If they are mandated to fill at another pharmacy, we will let you know. This means less disruption, faster starts and consistent support.

We’re here to help

To learn more about these changes and how we can help, contact your local Optum Specialty Pharmacy account manager.

Providers call: 1-855-215-0235

For Optum Infusion Pharmacy call:

Chronic conditions: 1-877-342-9352

Bleeding disorders and Alpha-1: 1-855-855-8754

To learn more, visit:

cms.gov/priorities/medicare-prescription-drug-affordability/overview/medicare-part-d-improvements