Why integrated specialty medication management is best for business

Studies show that human resources managers place a high value on the entire range of pharmacy benefit manager services:

- Pricing negotiations

- Reporting

- Medical management

- Utilization management

- And more1

Nowhere is this integrated approach more valuable than in supporting patients taking complex, high-cost specialty medications. In particular, Optum Rx® has created a uniquely integrated, one-stop framework that delivers proven value to plan sponsors, using scale and efficiency to help drive down costs.

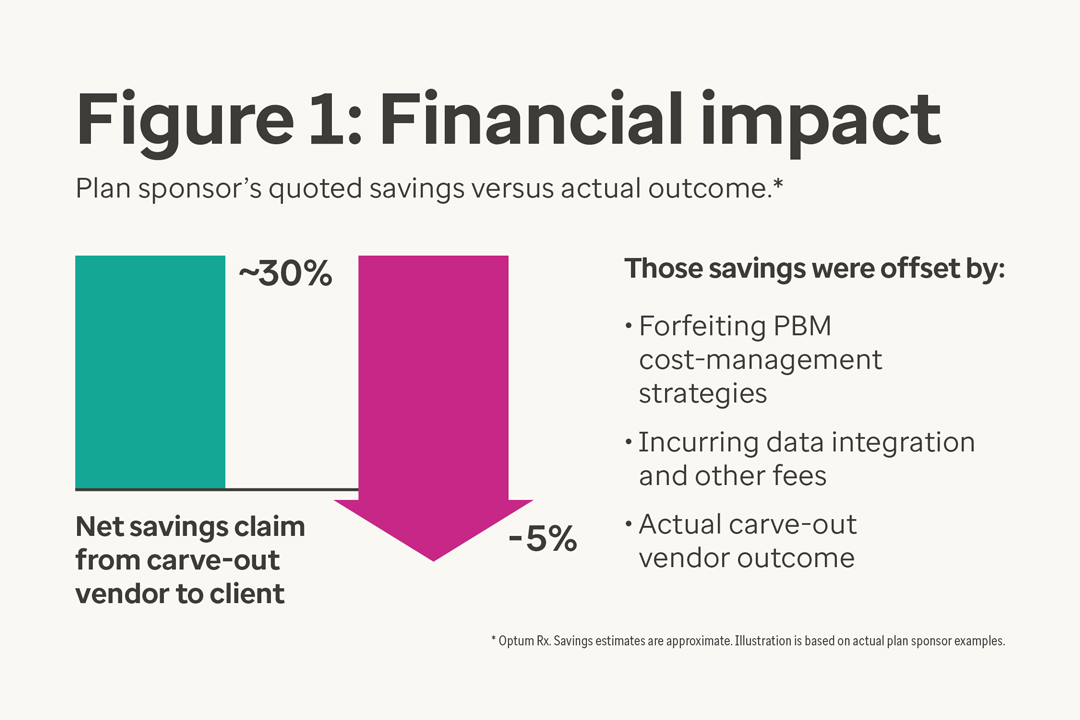

However, many employers are being advised to ‘carve out’ certain elements of their specialty management structure in an attempt to save money. But in the process, many of the advantages of integrated specialty care are lost. For example, pharmacists are unable to view a patient’s full therapy regimen and provide high-value pharmacy care services.

Truly integrated PBM services add far more value to your plan than any assemblage of bolt-on pieces. The power of the integrated model resides in the unity of the structure — just like a fully assembled vehicle. Each service connects to the others and has a role to play in supporting the overall structure.