How it works

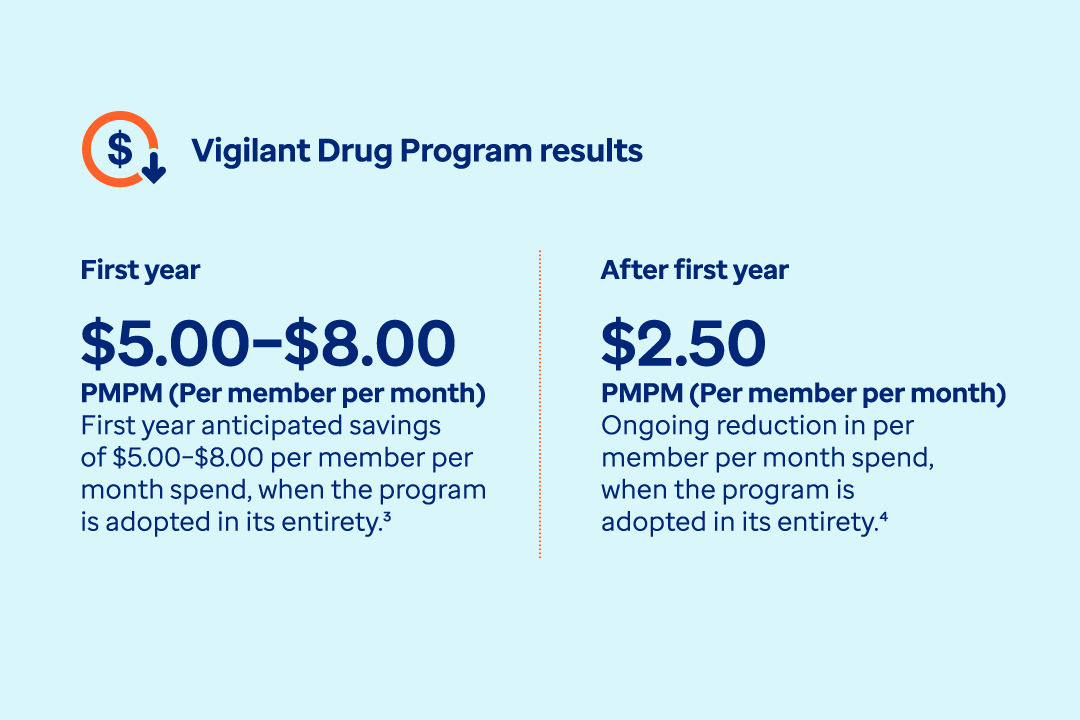

The Vigilant Drug Program gives you flexibility to limit access to certain categories of drugs, including new ones whose clinical and financial value are not yet established. The Vigilant Drug Program is modular and makes use of several clinical quality and cost-savings strategies to achieve robust overall per member per month (PMPM) savings.

The program includes clinical quality strategies to drive clinical appropriateness and cost savings.

- New drugs to market strategy — Temporarily excludes newly launched products until they can be formally reviewed by the Optum Rx National Pharmacy & Therapeutics (P&T) Committee. This program is a standard component of our Premium Formulary. This helps minimize member disruption and decrease financial risk until P&T review is completed.

- Clinical duplicates strategy — Excludes newer, more costly medications that offer little to no clinical advantage over existing medications with similar chemical composition and possible generic options. Examples include unique dosage forms, combinations of two or more available medications, unique strengths, certain delivery devices and multiple product kits/packages.

- Non-essential strategy — Excludes select high-cost, non-FDA-approved products or those deemed unnecessary. Encourages use of lower-cost, FDA-approved options with established safety and effectiveness for the same condition(s).

The program also includes cost-saving strategies to promote the use of clinically equivalent, lower-cost options.

- High-cost brands with generics — Excludes select high-cost brand products when a lower-cost, therapeutically interchangeable generic product is available.

- High-cost generics — Excludes high-cost generics when lower-cost alternatives are available with the same active ingredients or belong to the same drug class.