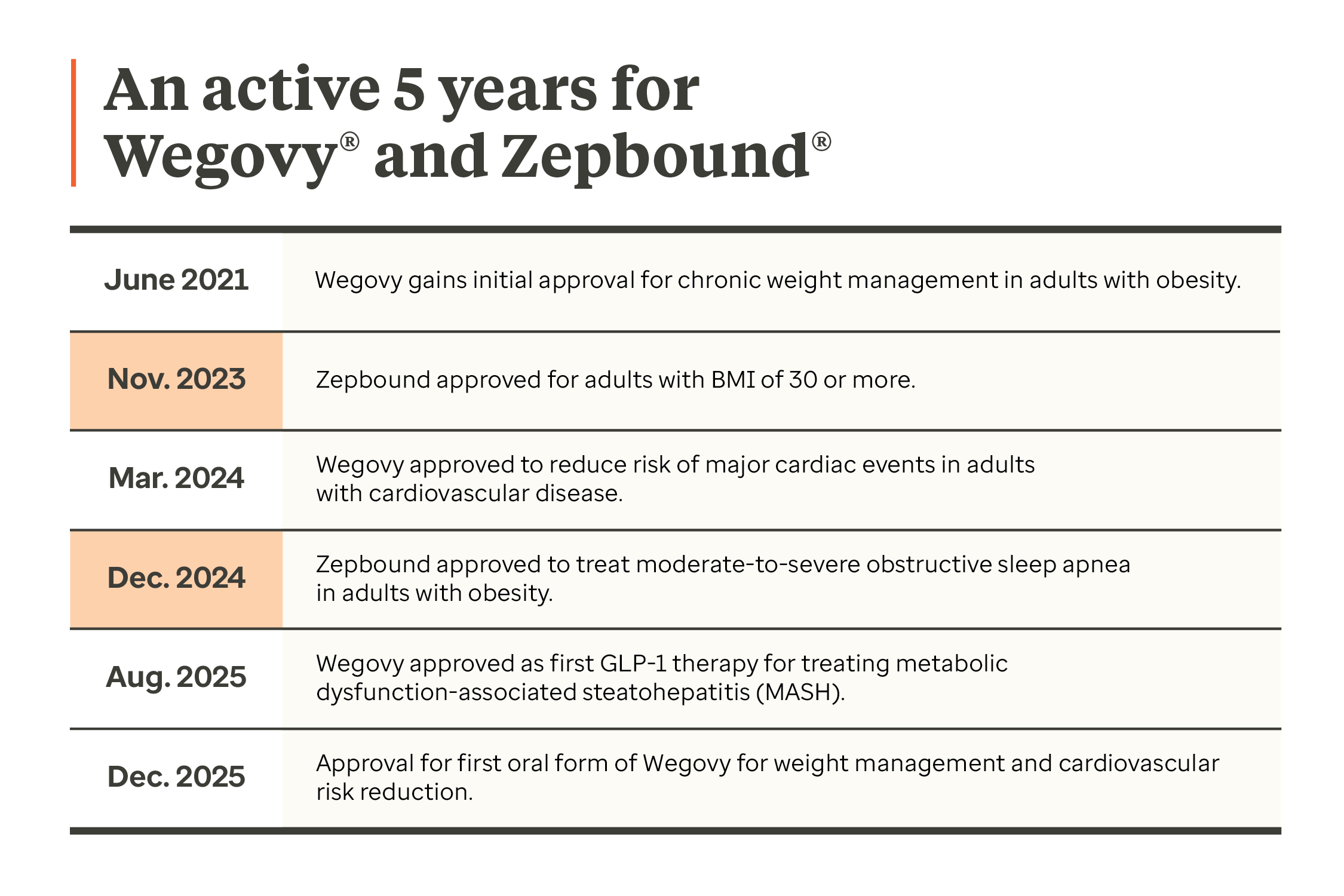

Over the past five years, the GLP‑1 treatment landscape has rapidly evolved. What was once a relatively small class of drugs has become one of the most significant drivers of pharmacy spend, transforming diabetes care and offering new treatment options to help address obesity.

During 2024 and 2025, the GLP-1 class was increasingly defined by expanded use cases and approvals, with existing drugs gaining indications including cardiovascular risk, sleep apnea and kidney disease.

The category is now entering a new phase as the arrival of oral options for weight loss and changing government policies look to shift use patterns and cost structures. For plan sponsors, understanding these dynamics is essential to safeguarding affordability while ensuring members receive high‑value care.

![First Oral GLP-1 Drug for Weight Loss [Report]](/content/dam/optum-dam/images/business/pharmacy/pharmacist-with-pills-1080x720.jpg)